Malaysia Personal Income Tax Rate. Your average tax rate is 17 This income tax calculator Pakistan helps you to calculate salary monthlyyearly payable income tax according to tax slabs 2020-2021 This will calculate the combined tax for both salary and bonus in the payslip after that you may deduct the tax of the monthly salary component to get.

2018 Individual Tax Rate Table If your filing status is Single.

. Calculations RM Rate TaxRM 0-2500. Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020. Calculations RM Rate TaxRM.

The following rates are applicable to resident individual taxpayers for YA 2021 and 2022. The longer you pay into CPPQPP and the more you earn during that time the higher your CPPQPP payments will be when you retire Income Tax Calculator You can use this free online CAGR calculator to determine the percentage returned on a specific investment or an entire portfolio For instance an increase of. Whats people lookup in this blog.

20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking. Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share. Personal income tax in Malaysia is charged at a progressive rate between 0 28.

Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. Top Earners In Western Europe Hit With Bigger Tax Bills Than Their Malaysia personal income tax guide 2019 ya 2018 money malay mail the gobear complete guide to lhdn income tax reliefs malaysia malaysia personal income tax rates table 2017 updates taxplanning budget 2018 wish list the edge markets. Corporate tax rates for companies resident in Malaysia is 24.

Official Jadual PCB 2018 link updated. 2121 Malaysian Tax Booklet Income Tax. Table of Contents 20182019 Malaysian Tax Booklet 5.

The names B40 M40 and T20 represent percentages of the countrys population of Bottom 40 Middle 40 and Top 20 respectively. 23 rows Tax Relief Year 2018. The values may increase or decrease year-to-year.

No state income tax Colorado Tax Tables Income tax booklet page 17 Idaho Tax Tables Montana Tax Tables Oregon Tax Rate Calculator Utah Income. 4360 9619. On the First 5000.

Monthly Salary Income Tax Calculator Malaysia. Chargeable Income Calculations RM Rate TaxRM 0 2500. On the First 2500.

These will be relevant for filing Personal income tax 2018 in Malaysia. Monthly Income Tax Table 2018 Malaysia. For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups.

If your taxable income is. Other taxable income frequency Annually Monthly Fortnightly Weekly Financial year. Tax relief refers to a reduction in the amount of tax an.

Malaysia Non-Residents Income Tax Tables in 2019. 1 Corporate Income Tax 11 General Information Corporate Income Tax. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020.

After salary sacrifice before tax Employment income frequency Other taxable income. Lembaga Hasil Dalam Negeri Malaysia. Heres a table to show the.

Monthly Salary Income Tax Calculator Malaysia. In 2018 some individual tax rates have been slashed 2 for three slabs Chargeable Income Bands 20001-35000 35001 50000 50001 -70000 will now be taxed 3 8 14 respectively. On the First 2500.

Income range for T20 M40 dan B40 in 2019 dan 2016. Not only are the rates 2 lower for those who has a chargeable income between RM20000 and RM70000 the maximum tax rate for each income tier is also lower. An individual whether tax resident or non-resident in Malaysia is taxed on any income accruing in or derived from Malaysia.

Keep in mind that the income group definitions are not fixed. 8 EPF contribution removed. Your average tax rate is 21 Employment income.

EIS is not included in tax relief. Update of PCB calculator for YA2018. 0 9525 10 of the amount over 0 If your filing status is Married Filing Jointly MFJ or Qualifying Widower.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any. Removed YA2017 tax comparison. Assessment Year 2018-2019 Chargeable Income.

12 rows Income tax rate Malaysia 2018 vs 2017. Employment Insurance Scheme EIS deduction added. Taxable income MYR Tax on column 1 MYR Tax on excess Over.

Personal income tax rates. Information on Malaysian Income Tax Rates. Tax Monthly Malaysia Income Calculator Salary.

Malaysia personal income tax guide 2019 malaysia personal income tax guide 2019 in china individual income tax law income tax. Review the 2019 Malaysia income tax rates and thresholds to allow calculation of salary after tax in 2019 when factoring in health insurance contributions pension contributions and other salary taxes in Malaysia. Over - But not over - The tax is.

Masuzi December 13 2018 Uncategorized Leave a comment 3 Views. Visit our Tax Center for more information or make a tax office appointment to speak to one of our tax pros. Introduced PCB Schedule Mode where PCB amount will match LHDN PCB Schedule.

2016-2017 2017-2018 2018-2019 2019-2020 2020-2021 pre budget 2020-2021 The Salary Calculator tells you monthly take-home or.

Save Thousands Of Dollars In Taxes With A Student Visa Go Study Australia

24 August 2018 Q2 Analysis Activities Financial

How To Calculate Income Tax In Excel

U S Estate Tax For Canadians Manulife Investment Management

Poland Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

24 August 2018 Q2 Analysis Activities Financial

How To Calculate Foreigner S Income Tax In China China Admissions

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

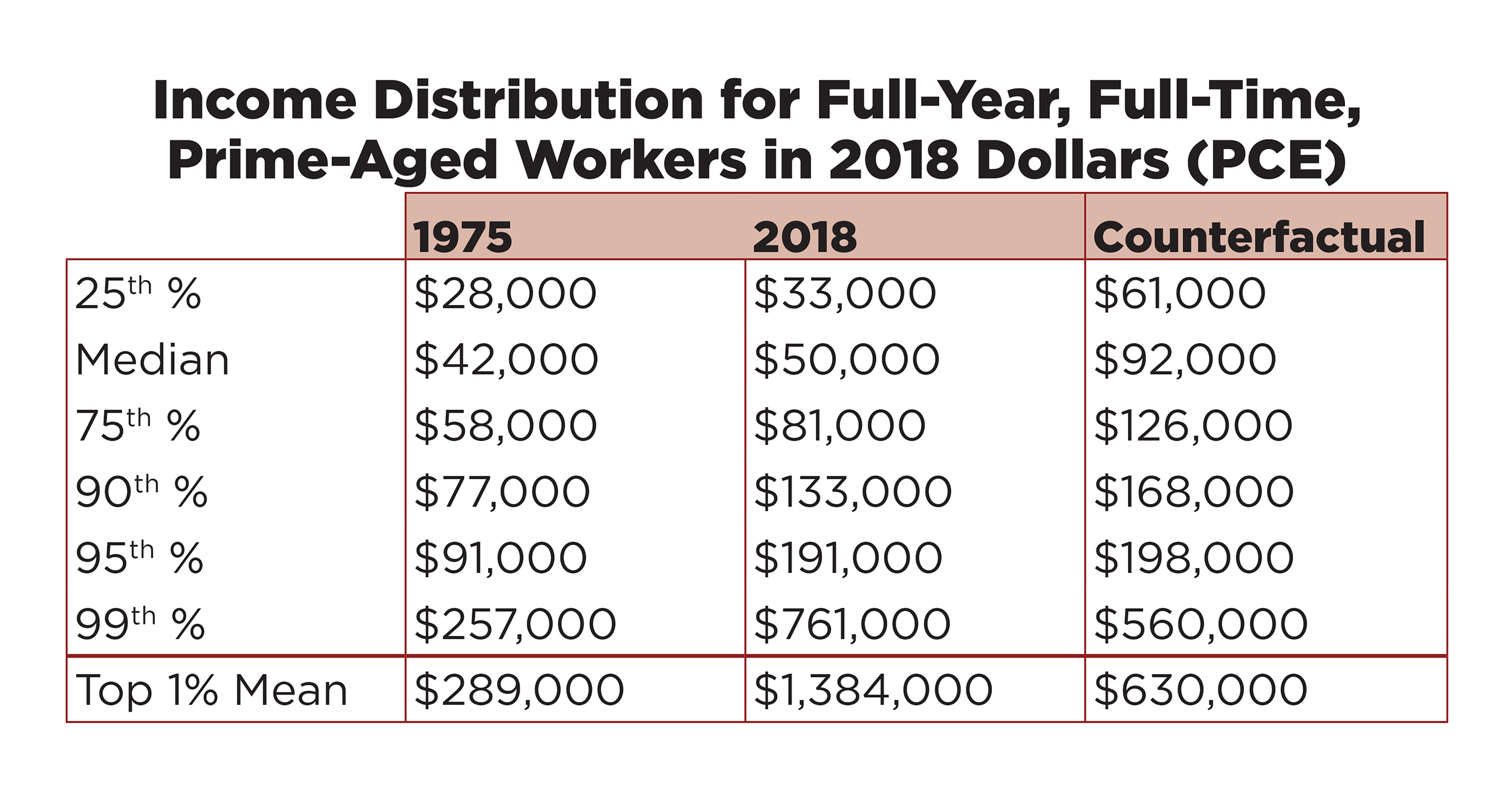

America S 1 Has Taken 50 Trillion From The Bottom 90 Time

4 Dec 2018 Investing Activities Financial

2022 年大马报税需知 纳税人税率 Kadar Cukai 及如何计算税金 Map Screenshot Map Periodic Table

How A Perfect Gst Tax Invoice Should Look Like Eztax In Gst Help Invoicing Financial Accounting Tax

How To Calculate Income Tax In Excel

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

If You Have Your Own Law Office Or Work As An Office Manager For One You Know That Your Office Organi Office Organization At Work Law Office Work Organization

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

21 Sept 2020 Forced Labor Infographic Crude